Following our Creative Economies Reports, we publish regularly updates of the ZCCE Creative Industries Economic Measures Switzerland.

This statistical analysis approaches the creative economies from an industry-based perspective along various submarkets.[1] It presents information on the creative enterprises – that is businesses and employees active in the creative industries sector – and their contribution to Swiss economic activity.

Mapping the Creative Industries Switzerland

Our research allows us to analyse the size, importance, trends and regional geography of the creative industries and its 13 submarkets in Switzerland.

Looking at the data, we can explore the number of businesses, employees, full time equivalents, generated gross value added and turnover of the creative industries and its 13 submarkets as well as the development over time and the local importance and specialisation in the cantons.

Source: FSO, STATENT, NA; STATZH, DISAGG-GVA; FTA, VAT; own calculations by Zurich Centre for Creative Economies (ZCCE) at ZHdK

Overview

In 2020, around 292,000 persons were employed in Switzerland’s creative industries in roughly 79,000 businesses. This represented 11.3% of Swiss businesses and 5.5% of all employees. The creative industries generated an estimated Gross Value Added (GVA) of CHF 35 billion and an estimated turnover of CHF 81 billion. This corresponded to almost 5.2% of Switzerland’s GVA and 2.3% of Switzerland’s total turnover.

Employment in Switzerland’s creative industries is highest in the submarkets Software and games industry (64,151, 21.9% of creative industries), Architecture market (58,679, 20.1%), Music market (29,614, 10.1%), Design industry (25,484, 8.7%) and Press market (23,402, 8.0%). These five submarkets account for more than two thirds of all creative industries jobs.

The figures confirm that the Switzerland’s creative industries are dominated by small businesses. 93% are micro-businesses employing up to 10 persons (FTEs). Around three quarters (77.4%) comprise merely one or two persons. Such businesses are known as smallest, i.e., micro-businesses. The pie chart shows that about half (44.2%) of all Switzerland’s creative industries employees work in micro-businesses, i.e., in businesses with less than 10 employees.

The creative industries are particularly concentrated (LQ > 1.2) in the canton ZH (% of total employment = 8.1%, LQ = 1.5), ZG (7.1%, 1.3) and BS (7.0%, 1.3).

Developments

In the first pandemic year 2020, the number of businesses in the creative industries decreased by 618 units compared to the previous year (-0.8%) to 78,500 businesses. Prior to that, this number had been rising steadily since 2011, by an average of 1.8% per year. The slump in 2020 was much more pronounced in the creative industries than in the overall economy, where there was a minus of -0.2% workplaces. The Broadcasting market was most affected by the decline (-9.7%), followed by Music industry (-4.5%), Performing arts market (-3.7%) and Crafts market (-3.6%).

In the same period, the number of employees in the creative industries, which had increased almost constantly since 2011, shrank by 6,544 employees (-2.2%) to 292,481 employees. The Performing arts market (-7.7%) and Broadcasting market (-7.2%) were particularly affected. In the overall economy, the number of employees fell by 0.6%.

The Covid-19 pandemic is particularly visible in the macroeconomic indicators of the creative industries. While overall economy’s nominal gross value added fell by 3.1% from 2019 to 2020, the creative industries sector’s nominal gross value added fell by 9.4% to a value of CHF 34.9 billion, a decline three times as large. The submarkets Performing arts market (-48.4%) and Music industry (-42.2%) were hit hardest.[2]

Methodology

Based on the classification for creative industries and its 13 submarkets according to ZCCE, we calculate the size and the development of the creative industries in Switzerland using the Structural Business Statistics (STATENT), the National Accounts (NA) and the Value Added Tax (VAT).[3]

In Switzerland, the creative industries sector is defined, with reference to the European debate, as those cultural and creative enterprises that are predominantly market oriented and are concerned with the production, distribution and media dissemination of cultural and creative goods and services.

The creative industries Switzerland are subdivided into 13 submarkets.[4] It is here that products and services are created, either for other production and service sectors or directly for the final consumer market. In this sense, the cultural and creative industries are mainly assigned to the private sector of cultural production – thus neither to the public sector (public cultural promotion) nor to the intermediate sector (foundations, associations). However, artists and creative professionals are often active in all three sectors. From their point of view, the three submarkets should be seen as parts of the same system. In addition to its own market structures, the cultural and creative industries also build on the creative potential of the public and non-profit sub-sectors and has an innovative effect on them. Therefore, the cultural and creative industries can only be seen as a holistic system.[5]

Further information in our Creative Economies Reports and in the Research Notes.

Notes

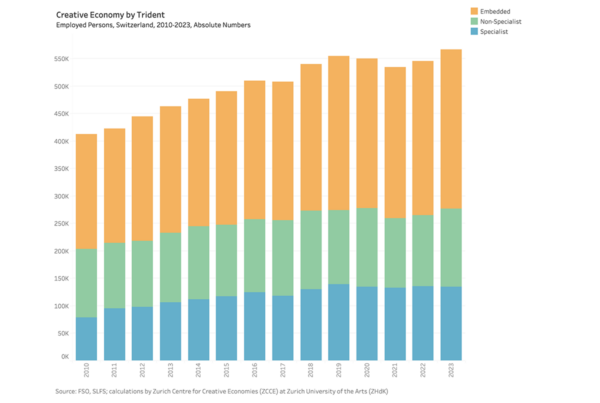

[1] See also our complementary analysis on creative workers, that is the employed persons working in the creative sector as well as persons working in creative occupations outside the creative industries.

[2] The real development of GVA is not (yet) available for methodological reasons. However, the structural business statistics (STATENT) only partially reflects the pandemic’s impact: Thanks to short-time working and loss of earnings allowances, a significant proportion of Old-age and survivor’s insurance (OASI) contributions continued to be paid, even when employees were prohibited from carrying out their work. The data underlying STATENT cannot therefore fully reflect the declines in activity in some sectors. A specific series for the years affected by COVID-19 must therefore be constructed (see FSO, experimental statistics).

[3] See Christoph Weckerle, Simon Grand, Frédéric Martel, Roman Page and Fabienne Schmuki, Entrepreneurial Strategies for a Positive Economy, 3rd Creative Economies Report Switzerland, Zürich 2018.

See Christoph Weckerle, Roman Page, Simon Grand: Von der Kreativwirtschaft zu den Creative Economies. Kreativwirtschaftsbericht Schweiz, Zürich 2016.

[4] See the classification of creative industries according to the approach used by the ZCCE in the annexe.

[5] See Christoph Weckerle, Hubert Theler, Die Bedeutung der Kultur- und Kreativwirtschaft für den Standort Zürich, Dritter Kreativwirtschaftsbericht Zürich, ZHdK 2010.